The Advantages of Choosing Money Lenders genuine Estate Investments

In the world of actual estate investments, choosing the ideal funding resource can considerably affect a financier's success. Cash loan providers provide unique advantages, such as expedited accessibility to funds and tailored funding alternatives that cater to individual financial situations.

Faster Access to Funds

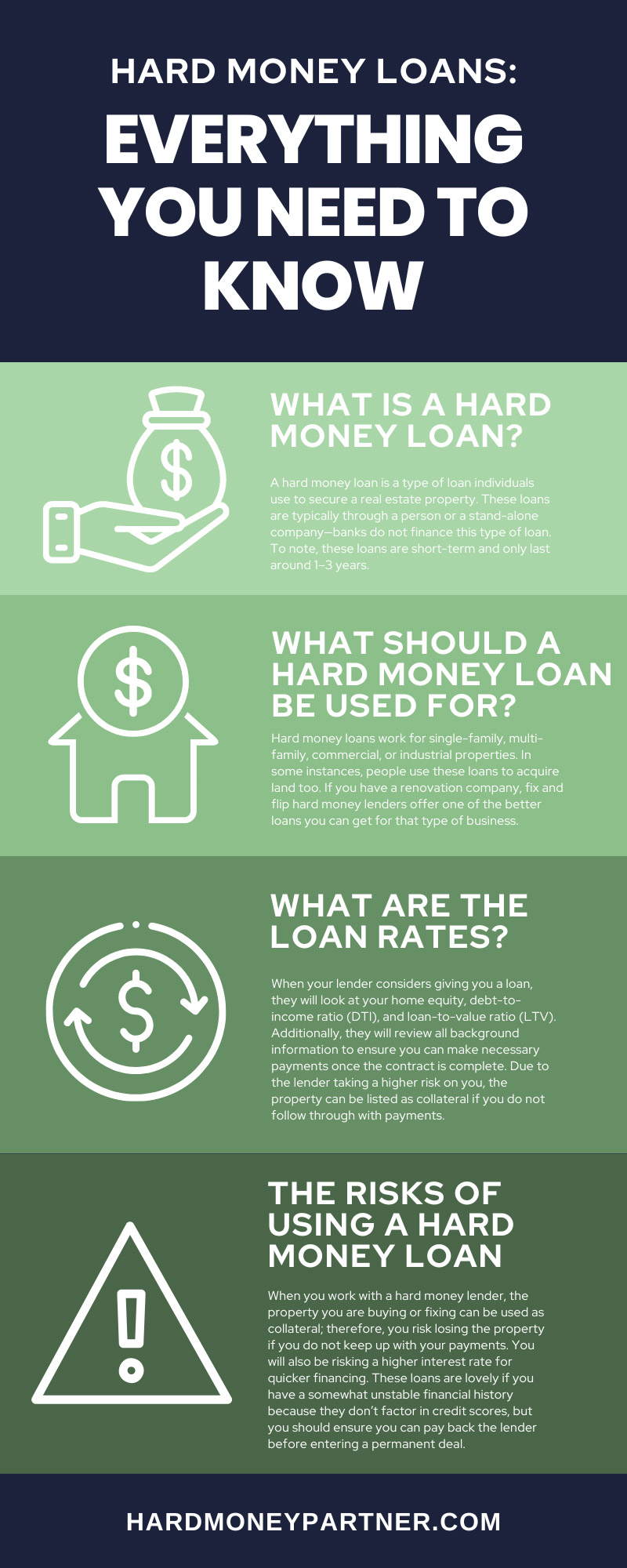

In the competitive landscape of real estate investing, time is typically important, making quicker access to funds an essential advantage. Investors frequently experience possibilities that require instant monetary dedication, such as auctions or troubled home sales, where delays can cause missed out on possibilities. Cash lending institutions, specifically personal lending institutions and tough money loan providers, can give expedited lending procedures that conventional financial institutions typically can not match.

Commonly, these loan providers enhance their application and approval treatments, concentrating much less on considerable paperwork and more on the prospective value of the property. This change allows capitalists to safeguard funds in an issue of days, instead than months or weeks. Additionally, cash lenders typically have a higher determination to evaluate the property's equity instead of the customer's credit report history, further speeding up the financing procedure.

In addition, the capacity to access funds swiftly encourages investors to act emphatically, enhancing their one-upmanship in a fast-paced market. This dexterity not just promotes swift deals however can additionally result in a lot more favorable acquisition prices, as customers can offer prompt money offers. Eventually, quicker accessibility to funds is a crucial component for success in the vibrant world of realty investing.

Versatile Funding Alternatives

Providing a variety of car loan frameworks, cash loan providers accommodate the diverse needs of investor. Unlike traditional banks, which might enforce rigid lending standards, cash lending institutions supply adaptable options that can be tailored to particular investment strategies. This versatility permits financiers to select from different finance types, consisting of short-term swing loan, long-term financing, and also interest-only fundings, depending upon their job needs.

Furthermore, money lending institutions frequently use adjustable terms, making it possible for investors to bargain repayment timetables, rate of interest, and car loan amounts that straighten with their monetary objectives - hard money lenders in georgia atlanta. This adaptability is especially helpful for capitalists that may encounter unique circumstances, such as quick market changes or specific building kinds that call for specialized funding

Furthermore, money loan providers often examine the capacity of the investment home itself rather than the debtor's credit report rating alone, allowing skilled capitalists and novices alike to seize possibilities that might otherwise be unattainable. By giving a variety of finance options, money lenders empower actual estate financiers to make calculated choices, thus improving their capability to grow their portfolios efficiently and effectively.

Personalized Solution

Genuine estate investors benefit dramatically from the personalized solution provided by money lending institutions, which establishes them besides traditional financial institutions. Unlike traditional banks, money lending institutions usually take the time to recognize the one-of-a-kind circumstances and objectives of each investor. This customized method permits them to supply tailored financing solutions that straighten with the financier's details needs.

Cash loan providers generally have a more flexible decision-making process, allowing them to react quickly to demands and adapt to altering market problems. This agility is especially important in the busy property atmosphere, where possibilities can emerge and require instant activity. By developing a solid relationship with their customers, cash loan providers can provide insights and advice that are useful for making educated financial investment choices.

Cash loan providers commonly supply ongoing assistance throughout the life of the investment, helping clients with refinancing alternatives or additional funding as needed. Ultimately, the personalized solution supplied by money lenders improves the actual estate financial investment experience, paving the way for successful results.

Much Less Rigorous Needs

Cash lenders typically prioritize the building's prospective value and the investor's experience over strict credit rating assessments. This means that individuals with less-than-perfect credit report or those who are brand-new to property investing might still protect funding. Additionally, the documents process is usually streamlined, permitting faster approvals and lowered waiting times.

These much less check out this site strict needs make it possible for even more capitalists to enter the market and go after possibilities that could or else be out of reach. By concentrating on the advantages of the debtor and the investment's intent, cash loan providers help with an even more comprehensive financing avenue, promoting development in the realty industry. This permits financiers to take advantage of chances promptly, improving their opportunities of success in a competitive landscape.

Affordable Rates Of Interest

While typical lending institutions frequently problem borrowers with high rates of interest, money lenders regularly give affordable check it out prices that can significantly benefit real estate financiers. This advantage is especially important in an environment where investment margins are often limited and money circulation is a main issue for building owners.

Cash lenders normally operate with higher adaptability than typical banks, enabling them to offer customized lending items that straighten with the details requirements of realty tasks - hard money lenders in georgia atlanta. Their affordable passion rates may be less than those readily available with conventional banks, enabling investors to maximize their returns. Additionally, the transparency connected with cash lenders often means fewer surprise fees and charges, enabling investors to accurately assess the total expense of borrowing.

Furthermore, the ability to safeguard lendings swiftly can be a crucial variable in property financial investments. Cash loan providers offer expedited financing options, which can be instrumental in exploiting on time-sensitive chances, such as troubled homes or competitive bidding process circumstances. Hence, the combination of competitive passion prices and swift access to capital settings cash loan providers as an appealing alternative for savvy investor seeking to optimize their financial approaches.

Conclusion

Cash loan providers, particularly exclusive lenders and tough cash lenders, can provide expedited lending procedures that typical financial institutions frequently can not match.

Supplying a range of finance frameworks, money loan providers provide to the diverse needs of actual estate investors.Genuine estate capitalists benefit considerably from the customized solution offered by money loan providers, which establishes them apart from typical economic institutions. Hence, the combination of affordable interest rates and speedy accessibility to funding placements money loan providers as an eye-catching choice for smart real estate investors seeking to maximize their monetary approaches.

In conclusion, picking money lenders for genuine estate investments provides numerous advantages that can considerably benefit capitalists.